Harness the power of Fidelity's resources and industry experience

Fidelity Private Credit Fund (the Fund) leverages Fidelity's more than 50 years in the credit markets, more than $620 billion* in credit investments under management and our vast proprietary credit and equity research platform.

* Fidelity Investments as of 12/31/22An overview of Fidelity Private Credit Fund

Hear directly from Portfolio Manager David Gaito as he discusses the Fund, Fidelity's first business development company (BDC).

Your browser doesn’t support video.

Experience

A powerful combination of Fidelity’s 50+ years in the credit markets with a team that averages over 20 years of middle market lending experience

Risk Adjusted

Primarily invests in senior secured, floating rate loans that may help mitigate impacts in down markets and offer a hedge against rising interest rates

Capital Preservation Focused

Focused on capital preservation while seeking to generate current income greater than what is available in public credit markets

Access & Exposure

Provides exposure to private markets that have historically exhibited lower volatility and lower correlation to public markets

Compared to typical private credit investments

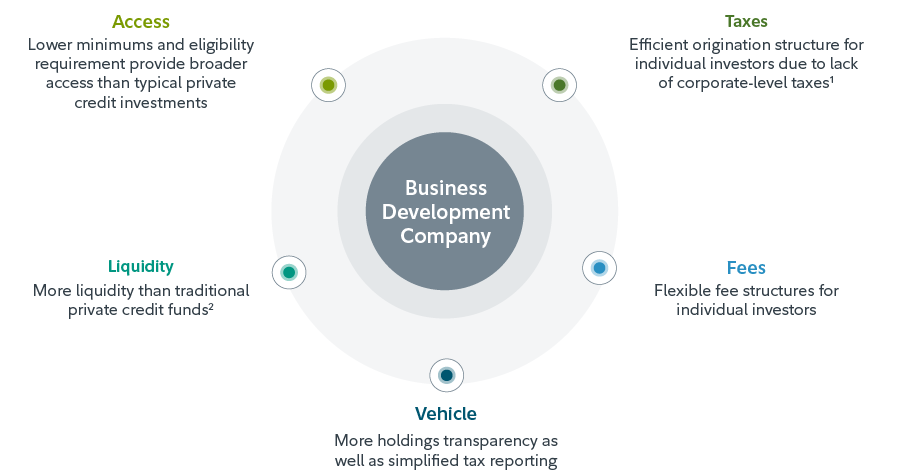

A BDC is a specialty finance company regulated under the Investment Company Act of 1940, that lends to businesses to help them meet their capital needs and grow. BDCs help investors generate current income by providing them access to these institutional loan investments. These loans typically provide higher dividend yields but include more credit risk than investment grade investments—and should not be considered a substitute.

1. Please note that this information is not intended to provide tax or legal advice and should not be relied upon as such.

2. Share repurchases are not guaranteed and are subject to board approval.

Financial Advisors interested in Fidelity Private Credit Fund

If you are an individual investor, please reach out to your Financial Advisor.

Fidelity Private Credit Fund

| PRINCIPAL TERMS | |

| Investment Adviser | Fidelity Diversifying Solutions LLC |

| Eligible Investors | Eligibility minimums apply and vary by state of residence. See prospectus for details. |

| Fund Structure | Public, non-listed, perpetually offered business development company (BDC) |

| Minimum Investment | Share class specific |

| Subscriptions | Monthly at NAV (fully funded) accepted on the first business day of each month with 5 business days advanced notification |

| Distributions | Monthly distributions not guaranteed and subject to Board approval |

| Liquidity |

|

| Leverage | Expected range 0.90X–1.5X debt-to-equity with a regulatory cap at 2.0X |

| Tax Reporting | Form 1099 DIV |

FEES |

|

| Management Fee | 1.25% of net (vs. gross) assets |

| Incentive Fee |

|

| Additional Fees CLASS S & D ONLY |

|

| SHARE CLASS SPECIFIC FEES | CLASS I | CLASS S | CLASS D | |

|---|---|---|---|---|

| Only available through certain non-Fidelity financial intermediaries |

||||

| Minimum Investment | $25,0001 | $2,500 | $2,500 | |

| Upfront Placement Fee | None | Up to 3.5% | Up to 1.5% | |

| Maximum Early Repurchase Deduction2 | 2.00% | 2.00% | 2.00% | |

| Total Annual Expenses | 5.08% | 5.93% | 5.33% | |

| Total Annual Expenses (after expense support)3 | 3.80% | 4.65% | 4.05% | |

Fees and Expenses shown are intended to assist you in understanding the costs and expenses that an investor in Common Shares will bear, directly or indirectly. Other expenses are estimated and may vary. Actual expenses may be greater or less than shown.

1. The Managing Dealer has waived or reduced from $1,000,000 for certain categories of investors.

2. Under our share repurchase program, to the extent we offer to repurchase shares in any particular quarter, we expect to repurchase shares pursuant to tender offers using a purchase price equal to the NAV per share as of the last calendar day of the applicable quarter, except that shares that have not been outstanding for at least one year may be subject to a fee of 2.0% of such NAV. The one-year holding period is measured as of the subscription closing date immediately following the prospective repurchase date. The Early Repurchase Deduction may be waived in the case of repurchase requests arising from the death, divorce or qualified disability of the holder. The Early Repurchase Deduction will be retained by the Fund for the benefit of remaining shareholders.

3. We have entered into the Expense Support Agreement with the Adviser pursuant to which the Adviser is obligated to advance all of our "Other Operating Expenses" (each, a "Required Expense Payment") for the 12-month period commencing September 23, 2022, and unless terminated, for each successive one-year period, to the effect that such expenses do not exceed 0.70% (on an annualized basis) of the Fund's NAV. The Adviser may elect to pay, at such times as the Adviser determines, certain expenses on our behalf (each, a "Voluntary Expense Payment" and together with a Required Expense Payment, the "Expense Payments"), provided that no portion of the payment will be used to pay any interest expense or distribution and/or shareholder servicing fees of the Fund. The Adviser will be entitled to reimbursement of an Expense Payment from Fund under certain conditions. However, the Adviser has waived its right to receive any reimbursement effective from the Fund's inception date until such time as revoked by the Adviser upon thirty days' prior written notice to the Fund. Because the Adviser's obligation to make Voluntary Expense Payments is voluntary, the fees above do not reflect the impact of any Voluntary Expense Payments from the Adviser.

Risk Factors

Investors should review the offering documents, including the description of risk factors contained in the Fund's Prospectus (the "Prospectus"), prior to making a decision to invest in the securities described herein. The Prospectus will include more complete descriptions of the risks described below as well as additional risks relating to, among other things, conflicts of interest and regulatory and tax matters. Any decision to invest in the securities described herein should be made after reviewing such Prospectus, conducting such investigations as the investor deems necessary and consulting the investor’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the Fund.

We have no prior operating history and there is no assurance that we will achieve our investment objective.

An investment in our Common Shares may not be appropriate for all investors and is not designed to be a complete investment program.

This is a “blind pool” offering and thus you will not have the opportunity to evaluate our investments before we make them.

You should not expect to be able to sell your shares regardless of how we perform.

You should consider that you may not have access to the money you invest for an extended period of time.

We do not intend to list our shares on any securities exchange, and we do not expect a secondary market in our shares to develop.

Because you may be unable to sell your shares, you will be unable to reduce your exposure in any market downturn.

We intend to implement a share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity and other significant restrictions.

An investment in our Common Shares is not suitable for you if you need access to the money you invest.

We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, or return of capital, and we have no limits on the amounts we may pay from such sources.

Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Adviser or its affiliates, that may be subject to reimbursement to the Adviser or its affiliates. The repayment of any amounts owed to the Adviser or its affiliates will reduce future distributions to which you would otherwise be entitled.

We use leverage, which will magnify the potential for loss on amounts invested in us.

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Shares less attractive to investors.

We intend to invest primarily in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value.